Raphael Abt, Christina Stappen, Eckhard Szimba (KIT)

2 March 2021

Introduction

Since mid-March 2020, travel restrictions and quarantine regulations have brought the global airline business close to a temporary standstill, leading to strongly declining airline revenues and reduced global economic activities. Restrictions for passenger transport resulted in a strong reduction of passenger flights which caused a significant lack of belly capacity for air cargo [1]. As cargo capacity in passenger aircraft usually accounts for more than 50 % of the available global cargo capacity [2], this loss has likely increased the utilization of cargo airplanes throughout the pandemic. This hypothesis is also supported by the fact that many passenger airlines around the globe have temporarily converted their planes for cargo handling to be able to meet the global air cargo demand [1], [3].

Methods for data compilation

In order to investigate the European air cargo market developments during the pandemic, we have analyzed the crowd-based COVID-19 dataset by Olive et al. (2021) which has been derived from Automatic Dependent Surveillance-Broadcast data (ADS-B) of The OpenSky Network [4]. In order to specifically study changes in air cargo services originating from European airports, we filtered the worldwide flight data for all flights that have departed from large- and medium-sized European airports as listed in the OurAirports database [5]. To identify departures that are explicitly linked to cargo aircraft, we further filtered the dataset for 1,300 cargo planes that by 9 January 2021 were in the possession of the IATA’ s top-25 leading cargo airlines according to scheduled freight tonne kilometers (FTK) in 2019 [6]. In addition, starting in April 2020, we filtered the dataset for all departures of 120 passenger aircraft that we identified as having been converted for cargo transport. The registries of all planes as well as their configurations – which were used to identify the respective aircrafts – were taken from the crowdsourced database of planespotters.net [7].

Findings

After eliminating outliers and inconsistencies, our final database for the years 2019 and 2020 comprises 8.5 million aircraft departures from European airports of 50 countries. From this database, 232,500 departures of cargo airplanes and 2,500 additional departures of converted passenger aircraft could be identified for both years. Whereas 107,200 cargo departures were identified in 2019, the cargo departures increased to 125,300 in 2020. Under consideration of the 2,500 additional departures of the 120 converted passenger aircrafts (which we address together with the real cargo aircrafts in the following), a raise of European cargo departures in the year 2020 by almost 19 % can be concluded compared to 2019.

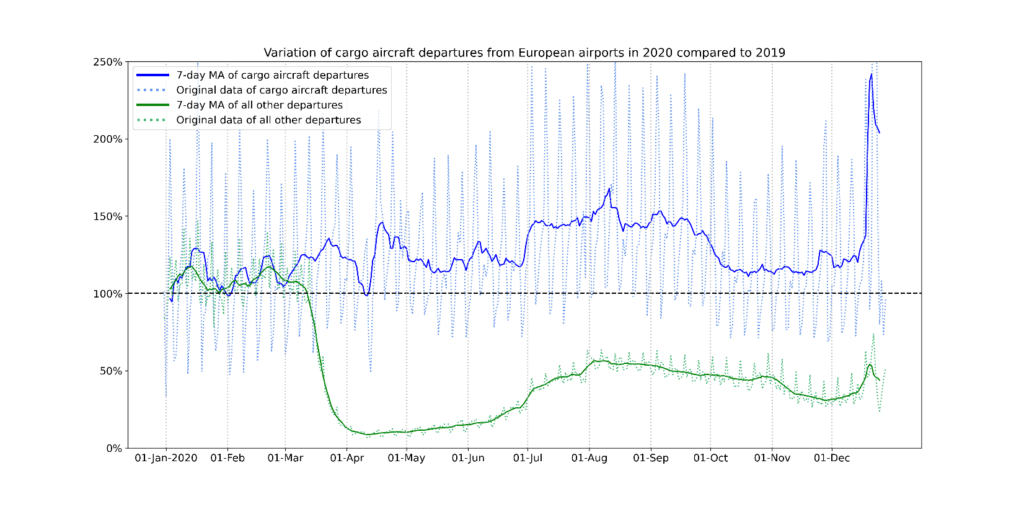

Figure 1: Variation of aircraft departures from European Airports in 2020 as 7-day moving average compared to 2019. As of April 2020, cargo aircraft departures include European departures of converted passenger airplanes. (Source: own calculations)

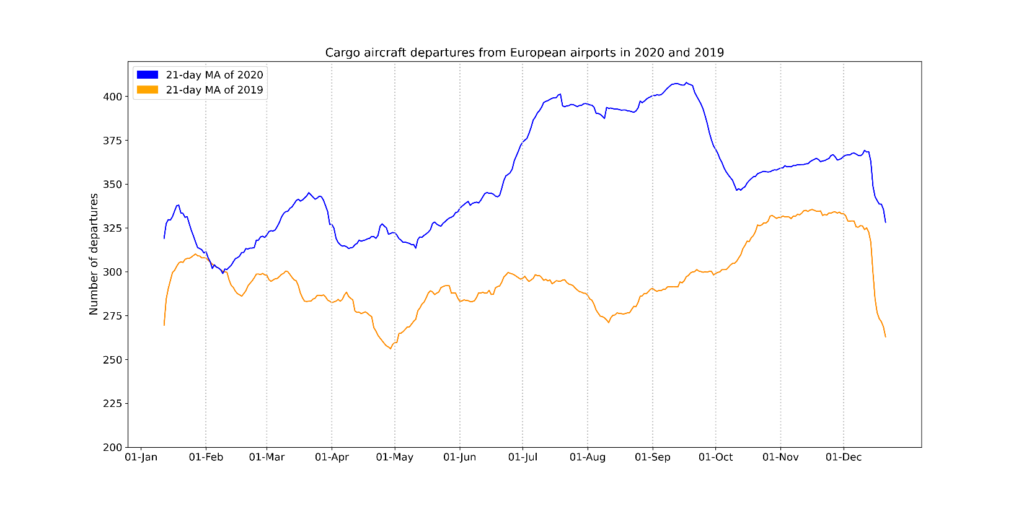

Figure 2: European cargo aircraft departures by IATA top-25 cargo airlines (by scheduled FTK) in 2019 and 2020 as 21-day moving average. As of April 2020, figures include European departures of converted passenger airplanes. (Source: own calculations)

Figure 1 shows the percentage variation of cargo airplane departures and all other departures (regular departures) in 2020 compared to 2019. While the first months of the year 2020 reveal only minor differences in numbers of departures, this pattern changes with the beginning of international travel restrictions in mid-March 2020. Thereafter, our data reveal an extensive decrease of regular departures, which indicates that these departures were largely dominated by passenger airplanes. While passenger related departures decreased, cargo airplane departures initially increased slightly in mid-March 2020, before shortly dropping below 2019 values in mid-April. A possible explanation for the brief rise was the substantially increased worldwide demand for masks, protective clothing and respirators which due to the lack of belly capacity needed to be transported by cargo aircraft [8]. The short drop below 2019 values can be explained by interim difficulties in global cargo flights due to uncertainties caused by rapidly changing and stricter international entry regulations, as well as by production interruptions. For the remaining part of the year 2020, the number of cargo departures remained clearly above the 2019 values. A particularly noticeable increase of cargo flights can be recognized during the summer period, reaching a year-on-year increase by more than 50 %, before declining at the end of September. However, the most pronounced increase of 2020 cargo airplane departures compared to 2019 occurred in the third week of December, when the number of cargo flights more than doubled compared to 2019. This is caused by a notably lower downturn in the number of cargo departures at the end of 2020 compared to 2019 (Figure 2). Although we did not find significantly higher numbers of cargo airplane departures at airports in proximity to COVID-19 vaccine production facilities in our data, the transport of vaccines could explain this significant upturn in number of departures. Apart from the time periods described above, the departure curves of 2019 and 2020 follow a roughly similar pattern.

Although the methodology of data compilation does not cover all cargo airplane departures in Europe, and relies on crowd-based data sources, the results reveal the importance of the air cargo sector during the pandemic. It is not without reason that the air cargo sector has been classified as “system-relevant” for maintaining vital societal functions [9], [10]. Due to its high system speed, air cargo is particularly useful for short-time delivery of urgently needed goods as well as goods that need special handling such as medical equipment and pharmaceutical products. Therefore, especially during the pandemic, the global distribution of life sciences and healthcare (LSH) products and urgently needed repair components for manufacturing companies has largely relied on air cargo [1], [8]. With recent governmental authorizations of COVID-19 vaccines which need special transport conditions, the reliance on the air transport sector has been increasing even further. Due to the high vaccine demand worldwide, DHL estimates a requirement for approximately 15,000 additional cargo flights [11].

Given the significant increase in global vaccine production and the expanding scope of destinations for vaccines, the air cargo sector will continue to expand its paramount role for mitigating and finally ending the COVID-19 pandemic.

Bibliography

[1] IATA, “Air Cargo Essential to Fight Against COVID-19,” 2020. Accessed: Jan. 12, 2021. [Online]. Available: https://www.iata.org/en/pressroom/pr/2020-03-16-01/.

[2] G. Knowler, “Belly cargo space won’t return to pre-pandemic level until 2024: IATA,” 2020. https://www.joc.com/air-cargo/travel-restrictions-keep-air-cargo-capacity-tight_20200728.html (accessed Jan. 13, 2021).

[3] C. Buyck, “More Airlines are stuffing Cargo into Passenger Seats to counter Coronavirus Slump,” 2020. https://www.forbes.com/sites/cathybuyck/2020/03/26/airlines-spot-revenue-opportunity-and-use-their-passenger-aircraft-to-ship-urgent-cargo/.

[4] X. Olive, M. Strohmeier, and J. Lübbe, “Crowdsourced air traffic data from The OpenSky Network 2020 [CC-BY],” Jan. 2021, doi: 10.5281/ZENODO.4419082.

[5] OurAirports, “List of Airports,” 2021. https://ourairports.com/ (accessed Jan. 09, 2021).

[6] Air Cargo News, “Top 25 cargo airlines 2019: FedEx retains the top spot as Qatar climbs,” 2020. https://www.aircargonews.net/airlines/top-25-cargo-airlines-fedex-retains-the-top-spot-as-qatar-climbs/ (accessed Jan. 12, 2021).

[7] Planespotters, “Airline Fleets,” 2021. https://www.planespotters.net/ (accessed Jan. 09, 2021).

[8] M. Bach, “All Hands on Deck: How critical life sciences and healthcare cargo keeps moving to safeguard patient health during the global COVID-19 crisis,” Delivered. The Global Logistics Magazine, 2020.

[9] Bundesministerium für Arbeit und Soziales, “Liste der systemrelevanten Bereiche.” https://www.bmas.de/DE/Schwerpunkte/Informationen-Corona/Kurzarbeit/liste-systemrelevante-bereiche.html (accessed Jan. 12, 2021).

[10] F. Zhang and D. J. Graham, “Air transport and economic growth: a review of the impact mechanism and causal relationships,” Transport Reviews, vol. 40, no. 4, pp. 506–528, Jul. 2020, doi: 10.1080/01441647.2020.1738587.

[11] DHL, “Delivering Pandemic Resilience,” Sep. 2020. https://www.dhl.com/global-en/home/insights-and-innovation/thought-leadership/white-papers/delivering-pandemic-resilience.html (accessed Jan. 10, 2021).

Related Articles

The 1950s are coming back! About retro mobility, retro logistics and retro shopping….

Wouter Dewulf & Roel Gevaers (University of Antwerp) Trend watchers predict a return of the 'roaring twenties' after this Corona period. A dark period of crisis is often followed by an active period where the population takes full advantage of the 'light...